With support of DOD funding Graphite One has completed the 2023 and 2024 drilling programs that expanded the measured and indicated resource and proven and probable reserve

Publication of a NI 43-101 compliant Feasibility Study will be filed in April 2025 — and is anticipated to triple the production rate disclosed in Graphite One’s 2022 pre-feasibility report (the “PFS”)

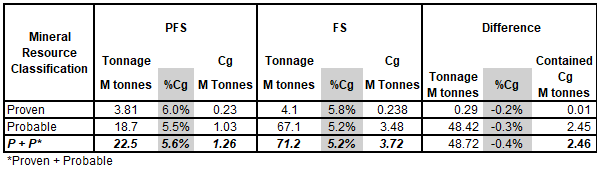

Proven/Probable Mineral Reserve tonnage is 317% of the PFS reserve estimate. The corresponding contained graphite is 296% of the PFS estimate

Graphite Creek is now triple the size it was when USGS just 3 years ago deemed it “the largest flake graphite deposit in the U.S.”

March 27, 2025 – Vancouver, British Columbia – Graphite One Inc. (TSX‐V: GPH; OTCQX: GPHOF) (“Graphite One”, “G1” or the “Company”), is pleased to announce updated mineral resource and reserve estimates for its Graphite Creek Project. Graphite One will file a feasibility study (“FS”) prepared in accordance with National Instrument 43-101 (“NI 43-101”) under the Company’s profile on SEDAR+ at www.sedarplus.ca within 45 days of the date of this news release, anticipated to be filed in April 2025.

“With grant support under the Defense Production Act Title III authorities, Graphite One was able not only to accelerate completion of our feasibility study by 15 months, but also quadrupled our planned drilling program, producing the results we announce today,” said Anthony Huston, CEO of Graphite One. “We will now enter the permitting process with a production rate triple what we projected just over two years ago. The Proven and Probable Mineral Reserve tonnage is 317% of the PFS reserve estimate and the corresponding contained graphite is 296% of the PFS estimate. All of this is based on results from just 1.2 miles of the total 9.5 mile long geophysical anomaly.”

Graphite One’s announcement today follows the publication last week of President Trump’s Executive Order (“EO”), “Immediate Measures to Increase American Mineral Production. Graphite One’s press release on the EO can be found at this link.

“With President Trump’s new Executive Order, G1 is working with Congress, the Administration, and federal agencies to accelerate our Graphite One supply chain project through permitting and into production, to end the nation’s 100% import dependency for graphite,” Mr. Huston added. “With these new results, Graphite Creek is now triple the size when the US Geological Survey reported just three years ago that Graphite Creek was the largest flake graphite deposit in the U.S[i]”.

Mineral Resource and Reserves

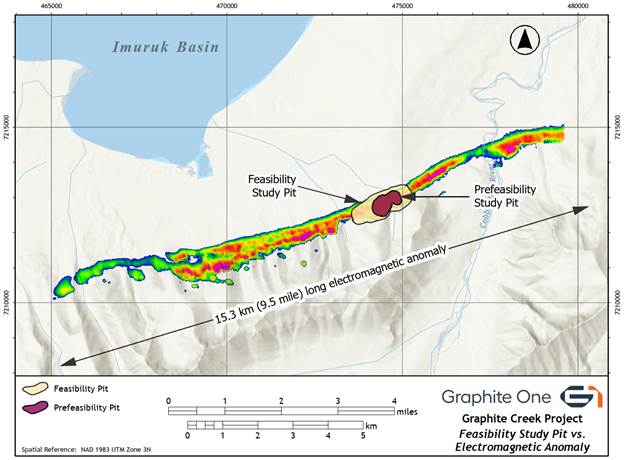

The Graphite Creek property (the “Property”) is located on the Seward Peninsula, Alaska about 38 miles (60 km) north of Nome. The Property comprises 23,680 acres (9,600 hectares) of State of Alaska mining claims. The claim block consists of 176 claims, of which 163 are wholly owned by Graphite One (Alaska) Inc. and 13 are leased to Graphite One (Alaska) Inc. G1’s deposit is entirely on State land. The graphite mineral zone is exposed on the surface and strikes East/Northeast along the North Face of the Kigluaik Mountains. The Feasibility Study Pit and Mineral Reserve footprint represents just 1.2 miles (1.9 km) of the 9.5 miles (15.3 km) long electromagnetic anomaly (Figure 1).

Figure 1: FS pit versus PFS pit superimposed on electromagnetic (EM) survey anomaly

Through 2022, 2023 and 2024, 90 holes have been drilled in the resource area for a total of 13,482 meters of drilling. The resource database consists of 22,806 assays. The resource remains open down dip, and along strike to the East and West.

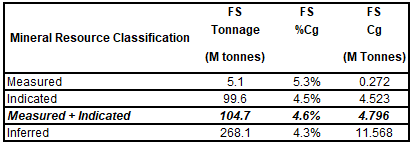

The Mineral Resource Estimate for Graphite Creek was updated with data through the 2024 drilling program. The methodology used was the same as that described in the PFS. A lower cut-off grade of 2% was used for the 2022 and 2024 resource. The FS mineral resource estimate is presented in Table 1.

Table 1: 2024 Feasibility Study Mineral Resource Estimate 2.0% Cg Cutoff Grade[1]

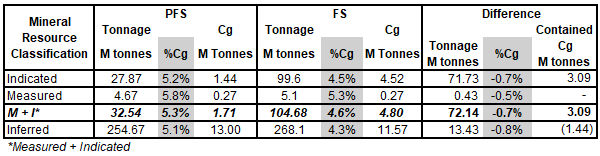

The 2023-2024 drilling program focused on converting Inferred Resources into Measured and Indicated, to allow annual graphite production to be increased in the FS. A comparison of the PFS and FS mineral resources can be seen in Table 2.

Table 2: Mineral Resource Comparison – 2024 FS vs 2022 PFS1

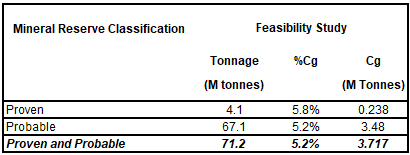

The 2024 Mineral Reserve consists of 71.219 million tonnes of Proven and Probable material at an average diluted grade of 5.22% graphite, yielding 3.7 million tonnes of contained graphite. A variable cut–off grade between 2%-3% was used in calculating the proven/probable reserve. Table 3 shows the mineral reserve.

Table 3: Graphite Creek Feasibility Study Mineral Reserve Estimate[2]

The FS Mineral Reserve estimate tonnage is 317% of the PFS reserve estimate and the contained graphite is 296% of the PFS estimate. A comparison of the PFS versus FS mineral reserve can be seen in Table 4.

Table 4: Mineral Reserve Comparison – 2024 FS vs 2022 PFS

Graphite One’s Domestic Supply Chain Strategy

With the United States almost 100 percent import dependent for anode active materials, Graphite One is developing a complete U.S.-based, advanced graphite supply chain solution anchored by the Graphite Creek deposit, recognized by the US Geological Survey as the largest graphite deposit in the U.S. “and among the largest in the world.” The Graphite One Project plan includes an advanced graphite material and battery anode material manufacturing plant located in Warren, Ohio. The plan also includes a recycling facility to reclaim graphite and the other battery materials, to be co-located at the Ohio site, the third link in Graphite One’s circular economy strategy. The building of these facilities remains subject to financing.

About Graphite One Inc.

GRAPHITE ONE INC. continues to develop its Graphite One Project (the “Project”) to become an American producer of high-grade anode materials that is integrated with a domestic graphite resource. The Project is proposed as a vertically integrated enterprise to mine, process and manufacture anode active materials primarily for the lithium‐ion electric vehicle battery market. As set forth in the Company’s 2022 Pre-Feasibility Study, graphite mineralization mined from the Company’s Graphite Creek Property, situated on the Seward Peninsula about 60 kilometers north of Nome, Alaska, would be processed into concentrate at an adjacent processing plant. Natural and artificial graphite anode active materials and other value‐added graphite products would be manufactured from the concentrate and other materials at Graphite One’s proposed advanced graphite materials manufacturing facility to be located in northeastern Ohio.

Qualified Person and Technical Report

Mr. Rob Retherford, P. Geo, with Alaska Earth Sciences, Inc. provided oversite to the 2022-2024 drilling, sampling, and QA/QC programs. Mr. Retherford is a Qualified Person as defined under NI 43‐101 and has reviewed and approved the technical content of this release.

Mr. Chotipong Somrit with Barr Engineering Co. prepared the FS Mineral Reserve Estimate and inspected the Graphite Creek Project site on August 12th, 13th, and 14th of 2024. Mr. Somrit is a Qualified Person as defined under NI 43‐101 and has reviewed and approved the technical content of this release.

An FS supporting the results disclosed herein will be published within 45 days. The effective date of the FS is March 25, 2025. For readers to fully understand the information in this release they should read the technical report in its entirety when it is available on SEDAR+, including all economic analyses, qualifications, assumptions, exclusions and risks. The FS is intended to be read as a whole and sections should not be read or relied upon out of context.

On Behalf of the Board of Directors

“Anthony Huston” (signed)

For more information on Graphite One Inc., please visit the Company’s website, www.GraphiteOneInc.com or contact:

Anthony Huston

CEO, President & Director

Tel: (604) 889-4251

Email: AHuston@GraphiteOneInc.com

Investor Relations Contact

Tel: (604) 684-6730

On X @GraphiteOne

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All statements in this release, other than statements of historical facts, including those related to the mineral reserves and resources, the timing of the issuance of the news release disclosing the results of the feasibility study and the filing of the full feasibility study and events or developments that the Company intends, expects, plans, or proposes are forward-looking statements. Generally, forward‐looking information can be identified by the use of forward‐looking terminology such as “proposes”, “expects”, “is expected”, “scheduled”, “estimates”, “projects”, “plans”, “is planning”, “intends”, “assumes”, “believes”, “indicates”, “to be” or variations of such words and phrases that state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. The Company cautions that there is no certainty that the EO will impact the Company as set forth in this press release. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date it is expressed in this press release, and the Company undertakes no obligation to update publicly or revise any forward-looking information, except as required by applicable securities laws. For more information on the Company, investors should review the Company’s continuous disclosure filings that are available at www.sedarplus.ca.

[1] Footnotes:

- Mineral Resource Statement is effective, March 25, 2025

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves have not demonstrated economic viability. There is no certainty that any part of a Mineral Resource will ever be converted into Reserves.

- Inferred Mineral Resources represent material that is considered too speculative to be included in economic evaluations. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Indicated or Measured Mineral Resources. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category.

[2]Mineral Reserve Footnotes:

- Mineral Reserves follow CIM definitions and are effective as of 25 March 2025.

- The Mineral Reserves are inclusive of mining dilution and ore loss.

- Mineral Reserves are estimated using a raised variable cut-off of 2.0% Cg – 3.0% Cg which is required to maximize secondary treatment production. The economic value is calculated based on a net average Graphite Price of US$1,200/t (including transport & treatment charges), 3.5% – 8.0% royalty, and a mill recovery of 90%.

- The final pit design contains an additional 7.6 Mt of Measured and Indicated resources between the raised cut-off grade (3.0% Cg) and the economic cut-off grade (2.0% Cg) at an average grade of 2.4% Cg. These resources have been treated as waste in the final mine production schedule.

- The final pit design contains an additional 40.4 Mt of Inferred resources above the economic cut-off grade (2.0% Cg) at an average grade of 3.9% Cg. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that any part of the Inferred Resources could be converted into Mineral Reserves.

- Tonnages are rounded to the nearest 1,000 t, graphite grades are rounded to two decimal places. Tonnage measurements are in metric units.

- Totals may not add due to rounding.

[i] https://www.usgs.gov/news/technical-announcement/usgs-updates-mineral-database-graphite-deposits-united-states